This post may contain affiliate links. If you purchase products or services linked from this page, Summit of Coin may receive a small commission at no extra cost to you.

March finds my wife and I preparing for our cruise. We are going to celebrate 5 years of marriage approximately 9 months late. Thus, it’s really closer to a celebration of 6 years of marriage. I guess, in the end it really doesn’t matter what we call it, all that matters is that we are taking some time off to celebrate our relationship with each other.

February was a pretty non-eventful month for the Summit of Coin household. We spent most of the month on the hamster wheel, just driving back and forth to work. With all the craziness of our daily lives, it will be nice to enjoy a week off together with my wife.

In terms of our goals, February was a good month in the Summit of coin household! Let’s dig into our goals and our updates for the month:

Goal #1 Update:

Goal #1 is our mortgage payoff goal. Last month, I shared that we had a goal of paying off $12,000 of our mortgage in 2019. That’s approximately $1,000 a month towards the mortgage. Below is a list of the principal paid off for each month:

January: $982.11

February: $984.56

TOTAL - $1,966.67

This amount is based on us just paying the minimum mortgage payment every month. Thus, we are a little bit under the amount needed to reach $12,000 by the end of the year, however, the amount of principal paid will increase each month and will cross over $1,000 mark in July. Therefore, we probably won’t need to pay any extra on the mortgage to reach our goal by the end of the year.

Goal #2 Update:

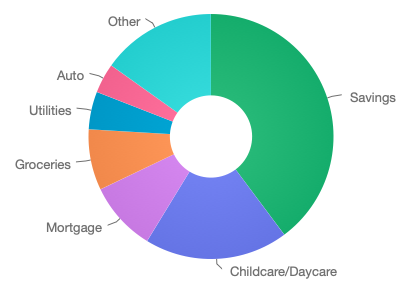

Goal #2 is our goal to save over $68,000 over the course of 2019. This is a big jump from last year, as we saved around $44,000 last year. That increase happened, because we are focusing on more tax-deferred savings options, whereas, last year we focused on emergency funds and mortgage payoff.

Below is a look at our savings over the course of February:

The $4,584.40 saved in February, includes principal payoff of our house. I consider that savings as that is money that is our money, that we will see once we sell the house (not anytime soon).

The beautiful thing about this list is that most of the savings are automated. Mortgage payment, 401k, 403b and 457s are all savings accounts that are directly pulled out of our paychecks. Thus, our savings will continue to remain around $4,000+ each month.

Below is a look at our savings over the entire year:

Two months in, I can’t complain about our savings. I am happy with the path we are taking. However, based on the first two months, we are falling behind a little on reaching our savings goal of more than $68,000. Three areas affect this number:

My 457b contributions of $800 a month (800 x 12 = $9,600) needs to be increased to reach our goal of $12,000 saved in the account.

We have not invested in both of our daughters college funds. We are looking at doing our lump sum investments in March. ($2,000 for 2019 for our oldest, $2,000 for 2019 for our youngest and $2,000 for our youngest for 2018).

Our savings in the Emergency/Car Fund/Medical accounts is nowhere near the amount needed to reach $5,000 over the course of a year.

If we stay on our current path, we will save around $60,552.90 over the course of 2019. That’s a pretty dang good number. Sure, it doesn’t hit our goal, but I can’t imagine many people complaining about saving $60,000 in a year!

Goal #3 Update:

This year, with our increase in pre-tax savings, we increased our savings goal from 30% to 40%. In January, we came up a little short with a 34% savings rate. However, February saw a much better savings rate!

Our savings rate jumped up to 40% in February. In all actuality, we didn’t save that much more in February ($300) than we did in January. Therefore, the increase in savings rate must be based on lowering our spending in February.

2019 Savings Rates:

January: 34%

February: 40%

Year-to-Date: 36%

Our year-to-date savings rate, increased 2 percentage points from January to February and overall we are saving much more this year than we saved last year! Two months into 2019 and I am pretty happy with our progress towards our goals.

How are you doing in reaching your goals for 2019? Are you falling behind? What do you need to do to get back on track?

It has been over 3 months, since my last savings goal update article. Things have gotten pretty crazy as my wife and I booked a full fall. It has been great, but exhausting at the same time! With our busy fall, I gave myself permission to not focus so much on new articles and just be fully present all the time. Now, I have found time to sprinkle some articles in over the past 4 months. I found the time to write those articles while I was on flights by myself. I just edited and added to these articles as it came time to post. Now, that I dug into our busy schedule and lack of posting, what have we been doing?