This post may contain affiliate links. If you purchase products or services linked from this page, Summit of Coin may receive a small commission at no extra cost to you.

Goals, plans and new years resolutions. Those are the things that people do each year in anticipation for a brand new year. They’re going to make changes for the better. They’re going to start working out or losing weight. They’re going to buy a new home or pay a crazy amount of the mortgage off this year.

Most new year’s resolutions are short term and only really focus on one year. It makes sense to focus on a small timeframe to make things attainable. However, I have never been a big new year’s resolution fan, as most people don’t follow through with their resolutions.

I am also generally happy with my life and most of the years in the past, I never saw the point in making a new year’s resolution. I had also never been a big fan of goals, as I always tend to be intrinsically motivated and just do stuff that I tell myself that I am going to do. For example, I never had a set date for when I wanted to start this blog, but I knew I wanted to start writing about personal finance.

There was no official goal, but in my mind I was going to start a blog. One summer, I sat down, wrote ten articles and built a site. I posted the site about a month after I began preparing. No goal, just an expectation to get it done!

The same can be said for most of my new year’s plans. They are never really a goal, but instead a plan that I expect to complete. However, as I continually listen to podcasts, I am met with the importance of setting goals. Therefore, I have been big on pushing and setting goals the last couple of years. Sometimes we failed and sometimes we were successful.

One day as I was listening to the ChooseFI Podcast, Jonathan made a statement that made me think. I can’t remember what he exactly said, but this is the gist of his statement: “Why not make your goals crazy? Set it for $30,000 and if you only pay off $20,000, then you at least paid off $20,000!”

I think that is why I dislike setting goals, because I don’t want to fail. Last year, we set a goal of $20,000 principal paid off of our mortgage in 2018. We came up $4,000 short and paid off $16,000. I was disappointed, but maybe I should be happy that we got rid of $16,000 of principal (that’s something)!

That was pretty a long introduction to say that I am going to list off the items that my wife and I want to tackle in 2019. We have shifted our plan a little bit and are taking a focus on building up our 457b plans.

GOAL #1: Payoff $12,000 of our Mortgage

This is nowhere near our goal last year, but we are slowing down our aggression towards the mortgage in 2019. Instead, we have decided to ramp up our savings towards 457b plans. We made this decision after discovering how beneficial a 457b plan can be for anyone looking at taking a mini-retirement or even early retirement.

The millionaire educator gave us the motivation and the plan to make it a focus on the 457 plans. Once discovering the supercharged powers of the 457b, we immediately began investing! The estimated $12,000 is based on our monthly mortgage payment, as we should cross over the $1,000 paid off per month threshold this year.

GOAL #2: Save more than $68,000 in 2019

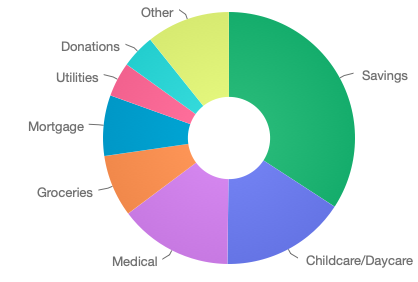

Wow! That number just jumps off the page…$68,000 in 2019! Last year, we invested/saved around $44,000 dollars without any goals. This year, we have a plan and can easily hit $68,000 of savings in 2019! Don’t believe it? Check out our plan below:

Note: My wife’s parents have some money that they saved for my wife over the years. This was money that was leftover from a wedding fund that they had set aside. After our wedding, they told us that the left over money will be used for college funds for our kids. This year, we will be using $4,026 of it to invest in ESAs for our youngest daughters college fund. Hence, I called it a match, because this is money from my wife’s parents.

Some people maybe saying, “$68,000 is a lot!,” but some may be saying, “You aren’t even maxing out all of your retirement accounts.” This is true. We will only be maxing out ONE retirement account. My wife’s 457b. The next closest account is my 457b. I don’t believe that I will reach $19,000, but I will try, especially if I have extra money come in!

I would like to max out all retirement, if possible, but you have to start somewhere. Increasing our savings from $44,000 dollars last year to $68,000 dollars is a daunting task in itself. Therefore, I will look at our goal as progress towards a future that we want. The important thing is that we are taking small steps each and everyday to better our future!

Within this plan, I added in mortgage payoff, college fund savings, and any other random savings that we may do in general savings accounts.

GOAL #3: Shoot for a 40% Savings Rate

For the past two years, we have been focusing on mortgage payoff and not taken a look at tax minimization. One of the biggest ways to increase your savings is to save in tax-advantaged accounts. These tax advantaged accounts allow you to save more money and pay less to the government.

Therefore, I realized that mortgage payoff wasn’t the most important thing in the world, but instead lowering your taxable income was the most important thing. Thus, my wife and I switched our focus and saw a jump in our savings rate at the end of 2019.

Due to an added focus towards tax advantaged accounts, we are shooting for a 40% savings rate, which should be easily attainable by hitting goal #2.

Updates

Last year, we focused on frugality and buy nothing new months. Each month, I dug into our spending and shared how we did in reaching our goal of buying nothing. This year, I will shift these updates. It will be less on our spending and more on whether we are meeting our savings goals and mortgage payoff goal.

With it being February already, I am going to dive into our January updates:

Goal #1 and #2 Update:

Depending on your point of view, I find it great that we saved over $4,000 in January. Not only is that a lot of money to be putting away for the future, but we did that all in ONE month! We are doing this while also paying for daycare for two kids and we cash flowed the added cost of a surgery for our oldest daughter.

The mortgage pay off is less than $1,000 currently, but should reach $1,000+ by the end of the year. I did not make a perfect estimate on the mortgage payoff and will let the mortgage just run its course.

Goal #3 Update

The $4,544 dollars saved could only get us a 34% savings rate in January. We took a hard blow from paying the deductible and co-insurance for my daughters ear surgery. We spent more on groceries than we wanted, but the rest of our spending was pretty good! I’m not too upset with a 34% savings rate that includes over $4,500 of savings!

Why Do We Have Such Crazy Goals?

We are saving at a crazy rate for a couple of reasons. We want to reach the Financial Summit or most people call it Financial Independence (FI). Once reaching FI, we can make a decision as a couple how to spend the rest of our life. We can choose to work if we would like, but we can also choose to do whatever we want.

In the near future, we are looking at taking a gap year or mini-retirement. We want a whole year to live as a family without all of the running around that is required when both of us are working 40-50 hours a week. It’s a plan to be crazy savers for a couple of years that could let us live for a year without the need to bring in any income!

Lastly, we are looking even further down the road. Eventually, my wife would like to work part time or maybe stay home with the kids. A couple years of really hard savings and the stay-at-home life is possible, without us needing to sell our home and downsize. We like our home, but also understand that we may need to move to make things work for our family.

What are your goals for 2019? Are you pushing yourselves towards some crazy savings goals?