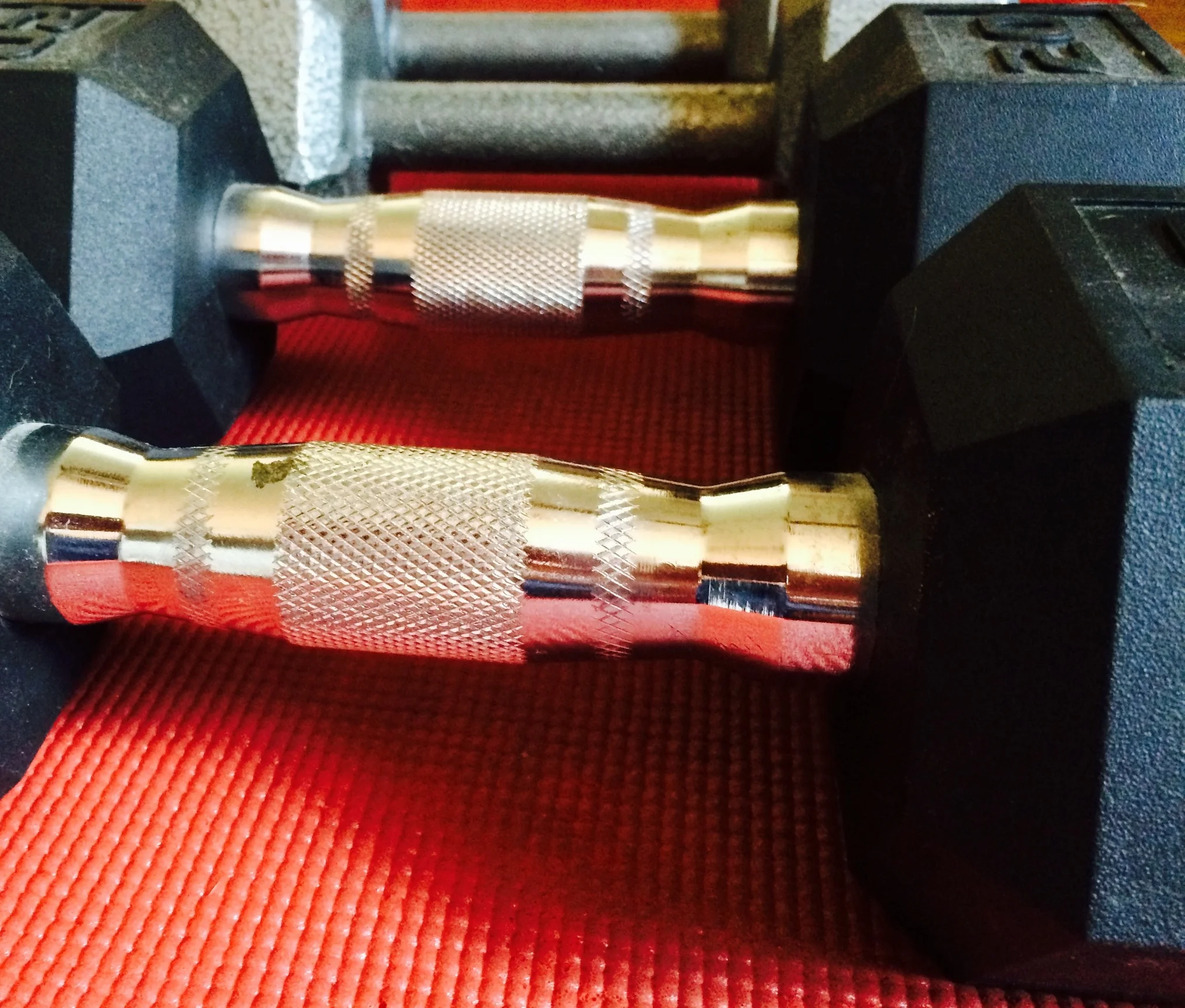

Photo: These weights will help you build up you bodily muscles, but saving is also a muscle that needs work.

As mentioned in an earlier article, Mr. Money Mustache is a blogger who retired at the age of 30. He teaches multiple strategies on how to destroy consumerism and grow your ‘stash. This is my story of how Mr. Money Mustache helped me build my saving muscle.

I actually have data to show the change in savings after reading Mr. Money Mustache. We will get to that in a little bit, but first we must start with a story. As I mentioned in an earlier article, we paid of my wife’s car on January 31, 2014. It was a great feeling to dump $15,000 of debt and it started opening up our income to saving. We began to save one of my wife’s paychecks monthly. Basically, we were saving 25% of our income, because my wife was planning to go part time when she started clinical during grad school. My wife and I began grad school in our first year of marriage and in February, we were only one semester into grad school. Both of us were working full time and attending school. This kind of put a strain on our free time. So, we decided to sacrifice some money and purchase meals from a placed called My Fit Foods. We decided that we wanted to eat healthy, but didn’t have the time to make dinner every night. Due to this, our grocery bill neared $950 every month. This is a lot of money, when you consider that Mr. Money Mustache and his family spend around $250 a month on groceries. I thought we were doing fine, because we were still saving half of my wife’s income every month.

Essentially, we were spending ¾ of our paychecks and saving ¼ of our paychecks. Actually a 25% savings rate is pretty good, but there was always expenses that we could have cut. Our savings rate was able to grow more starting the summer of 2014, when my wife’s parents moved to Houston. Their house had a guest house and they offered us the opportunity to live in the guest house rent free. The below chart will show the difference in savings rate before and after the move (Note: We were still purchasing My Fit Foods for lunches after we moved in with my wife's parents).

As you will notice, the savings rate improved substantially from the beginning of the year to the end of the year, which was aided on the fact that we moved into my wife’s parent’s guest house.

In December of 2014 while I was on Christmas break from my teaching job. I was listening to the dough roller podcast. I started listening to the dough roller podcast3 in the summer, but I was only listening to the most recent episodes. Over Christmas break, I decided to start listening to the podcasts from the beginning. That is when I listened to episode seven of the dough roller money podcast, hosted by Rob Berger. Rob Berger interviewed Mr. Money Mustache. I literally started taking notes and began to read every post from the website. I started at the first post and I am currently on the March 3, 2014 post. So, I have almost read three years worth of posts in just over a half a year. I have learned a lot from these posts, and our savings rate has improved slightly after reading Mr. Money Mustache. Let’s look at my wife and I’s savings rate since I started reading Mr. Money Mustache.

As you will notice, the savings rate increased from the 2014 savings rate. The savings rate was 29%, but has increased to 46% this year. During four of the seven months this year, we have had a savings rate over 50%. The other three months, items came up that caused us to not quite reach the 50% savings goal. In March, we paid 26% of our income in taxes. Without the tax bill, we would have saved 52%. In April, my aunt was deathly ill and in a coma, so we traveled to Nebraska unexpectedly to see her. This cost us 8% of our savings rate. Our savings rate would have been 47% without this expense. In May, we had to pay tuition, which was 25% of our expenses. We could have saved 57% of our income without the tuition expense. In June, we were looking at our first 60% savings rate until I had car trouble. The car repair cost us 12% of our savings rate. Emergencies happen, which is why we have an emergency fund, but the numbers do show that we have increased our savings rate, without the unexpected expenses in some of the months. Basically, I contribute the increased savings rate to Mr. Money Mustache. Ways that I have increased my savings rate are the following tips from Mr. Money Mustache.

- Cutting my own hair (bought a razor at the suggestion of this MMM article).

- Biking much more for groceries and work.

- Getting rid of consumerism.

- Thinking about expenses and not just buying things on a whim.

- Calculating my savings rate (each month I try to find ways to get my savings rate higher).

- Finding ways to lower our grocery bill (Dropped from $950 to $300 after reading MMM). It also dropped from a 6% spending rate in 2014 to a 4% spending rate in 2015.

Savings is just like any muscle, it takes time to make it larger. I hope to show you our monthly savings rate and talk about things that helped or hurt the savings rate. The savings rate is the biggest factor in early retirement. So, start building you savings muscle.

Below you will find a link to the razor that I purchased as a way to save money on haircuts. I no longer pay for someone to cut my hair.